Leveraging Compound Interest in Good Things

“In the simple mathematics of compound interest, if we deposit money in the bank at a given rate of interest and then return this interest to the existing principle, our money does not grow in a simple linear fashion. Rather, the interest added to principle accumulates still more interest through a positive feedback mechanism, causing the principle to grow at an accelerating rate through time – that is, exponentially.”

– Daniel Rigney ‘The Matthew Effect: How Advantage Begets Further Advantage’

There are two main drivers for basic humanity – the push towards pleasure and the pull away from pain. Having money – and by extension, the assurance of a buffer against unforeseen situations and events – is a pleasure. Examining your financial situation – and acknowledging less than ideal financial situations – is a pain. For better or for worse, it can be much easier to hide from the concept of ‘compounding interest’ than it is to acknowledge it – both from the aspect of pleasure and a point of pain.

It’s part of this perceived pain / pleasure effect, paired with the abstract nature of money and finance, and finally coupled by the human tendency to be lazy (perhaps further affected if there’s a degree of forgetfulness and avoidance about the issue).

However, ignoring and avoiding such a powerful principle as compound interest can put an individual, her family and even whole companies and countries at risk. Because, just as something can compound upwards, it can most probably compound downwards. And, even if you aren’t interest in making something compound and grow (such as a compound interest savings account), you should at least be in the position to appreciate avoiding negative (or downwards) compounding factors. An example of this is especially high interest debt such as credit card debt. What seems like minimum repayments on seemingly free money can very quickly slip into a years long fight against paying off ever compounding interest amounts in order to get around to repaying the original debt (which is lost in the balloon of compounded interest on the initial sum).

Let’s look at compound interest. This is so we can learn to look at it from a position of knowledge and the right mindset to steer the course of compound interest sin your favour.

The Absurd Probability of You Being Here

But first, a little on the sheer luck of you being here.

On the most morbid of statistical assumptions, you should not even exist. Especially as anything more complex than a mote of carbon-hydrogen compounds in this vast universe. The chances of being born as a sentient human on this Earth is phenomenal. Congrats! You’ve already beaten the odds.

Surviving and thriving are different ends of a spectrum, and in today’s complex world (and with the assumptions I am making via knowing you are reading this paragraph), I would surmise that you are a very very lucky human, compared to others (fluent English comprehension correlates to a certain level of economic success).

A long line of successful biological evolutions and personal growth and development has brought you to this exact moment in time.

You’ve already achieved so much. Is there now anything you should worry about?

Obviously, to bring such metaphysical questions back to reality, yes of course we all, as individuals and collectively, have a great deal to be worrying about. Life is not static, and we are constantly riding the balances between growth and decline, challenge and rest, cycles, rhythms, chance encounters and unknowable events.

Nothing is ever guaranteed. To know the future(s) itself is impossible. We can only do our best to understand the past and present, and to model to these probabilities as best as possible in order to attempt to understand the future and what it may bring.

If nothing in life is guaranteed, then why worry about Investing in your future?

Well yes, nothing really is ever ‘guaranteed’, which can bring about a great deal of anxiety. That’s why insurance companies make a lot of money – they are selling a ‘guarantee’ in some form, the assurance of whatever you are looking for to give you ‘peace of mind’. And indeed, although a lot of insurance may make a great deal of sense, there are also areas (individually factored) where the insurance is not necessary, or it won’t help. Sometimes, for better or worse, the insurance clauses makes the process of insurance a wasteful or ultimately useless endeavour.

But, when we start looking into probability, we see where some things which do add up, and help to make something more probable, more guaranteed – than not.

Your probability of succeeding in something usually increases when you chip away at it, or add bit by bit to something, continuously and consistently. Over a period of time, that’s where you will really start to see change occurring, and usually for the better.

Exponential Doubling

Let’s first get the fantasy of having everything you want growing forever at an almost impossible rate, out of the way. In mathematics, this concept is called ‘Exponential Doubling’.

In your wildest imaginations, you could want things like your money to just double in a day, grow seemingly endlessly until you become the richest person in the world, or the universe! So let’s break down exponential doubling, how it works and ultimately why this sort of growth can only exist in the realm of fantasy.

The Wise Man and the King | Rice on a Chessboard Problem

One day, a great King decided to reward a wise man for his lifelong service to his kingdom. He asked what the wise man wanted as a reward.

The wise man replied, “I simply want a grain of rice on this first square of this 64 square chessboard today. Tomorrow, I want double the amount from the first square placed on the second square of this chessboard, and on the next day, double the amount from the second square onto the third square – and for this to continue doubling, until every square is filled in 64 day’s time – that’s all I request your majesty.”

The king initially laughed at this, doing a few calculations – 1, 2, 4, 8, 16… – , and thinking, ‘this wise man won’t even end up with a bowl of rice by the end of this!’

It wasn’t until he had ordered this to be done, that within a week, the king began to worry.

If he had one grain of rice on the first square, two on the second, four on the third, eight on the fourth and so on, how many grains of rice would the wise man have by the time the chess board is full (64 squares in total).

The beginning of the rice on squares will then start small, but grow at a doubling rate incredibly quickly.

1, 2, 4, 8, 16, 32, 64, 128, 256, 512, 1024, 2048, 4096, 8192, 16,384, 32,768, 65,536, 131,072, 262,144, 524,288, 1,048,576, 2,097,152

The maths function for exponential doubling can be written as: y = 2²

In 22 days, the old man would have all of these amounts of rice, added together! Imagine at day 64. He would own all the rice in the kingdom and more. It just wouldn’t have been possible for the king to give the wise man what he requested. The king quickly apologised and asked if there was something else he could gift. The wise man relented and asked to marry one of the king’s daughters, to which the relived king agreed to and everyone* had a happy ending.

(*As problematic as that sounds.)

This is a mathematical problem which highlights compound interest with the process of ‘Exponential Doubling’. It also shows how, for reasons of economic instability (amongst other things), exponential doubling doesn’t really happen (or, not for long) in business and economy.

Exponential Doubling has Natural Checks & Balances

These are examples of exponential doubling. Now, being able to be in real life examples of exponential doubling may be harder to come by, and there would be a lot of checks and balances coming in to somehow halt you and any other biological system from taking full advantage of exponential doubling (bacteria which rapidly grows in ideal conditions would quickly overwhelm resources, and would experience a die off).

People, Economies and even biological systems won’t let you play this game – or, at least not for very long – before checks and balances come in and crush your dream of owning the whole world in a matter of months. It’s a fantasy, a fun maths exercise and altogether not realistic.

So, let’s instead turn our attention to the next best thing – a process which (in the current economic model) can be sustainable and still provide growth. Compound Interest.

Compound Interest | in a Nutshell

Compound interest begins growing something at the rate of the agreed point, and compounded at an annual rate. It’s not as ridiculously exponential as exponential doubling, but it’s the next best thing.

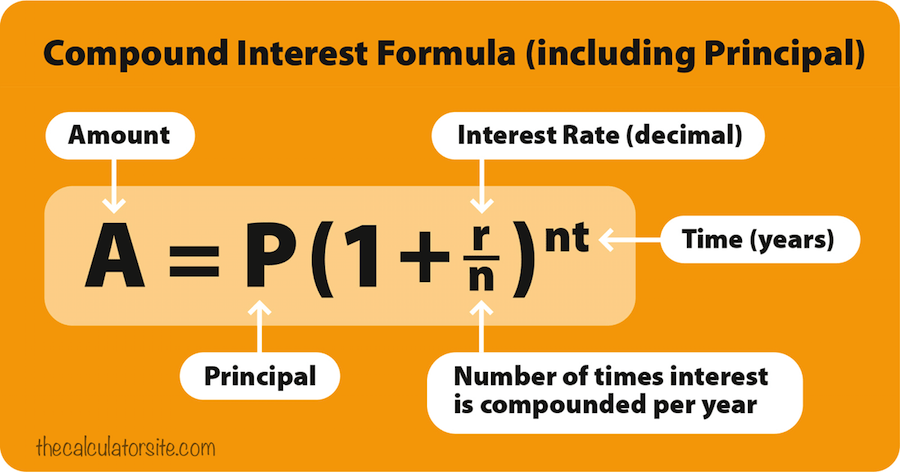

Compound interest as a principle can be expressed in a simple formula. The most common version of this formula, especially when looking at the example of money and calculating interest rates on something such as your savings account (assuming the savings account is a compound interest account), is seen below.

Where,

P = principle amount (the initial amount you borrow or deposit)

r = annual rate of interest (as a decimal)

t = number of years the amount is deposited or borrowed for

A = amount of money accumulated after n years, including interest

n =number of times the interest is compounded per year

Applying this Principle to your Savings

When you are to compound, say $100 at the rate of 5% for a year, at the end of the year, you will be left with $102.73.

Doesn’t sound so exciting? Well, what if we let this continuously compound over again for 10 years?

That will come out to $163. Still doesn’t sound like a lot?

Well, let’s keep adding $10o a year to that amount, and by the end of 10 years, you’ve got $1,484. That’s make $384 out of nowhere from the money you’ve saved and contributed.

Again, the magic of compound interest doesn’t really start showing itself until you continue to contribute, and allow more time to occur.

Putting $1000 into compound interest at 5% for 20 years, and adding $100 per year into that account nets you $6,126. If you only put $2900 into the whole enterprise, then that means $3226 is your windfall – starting to sound interesting now?

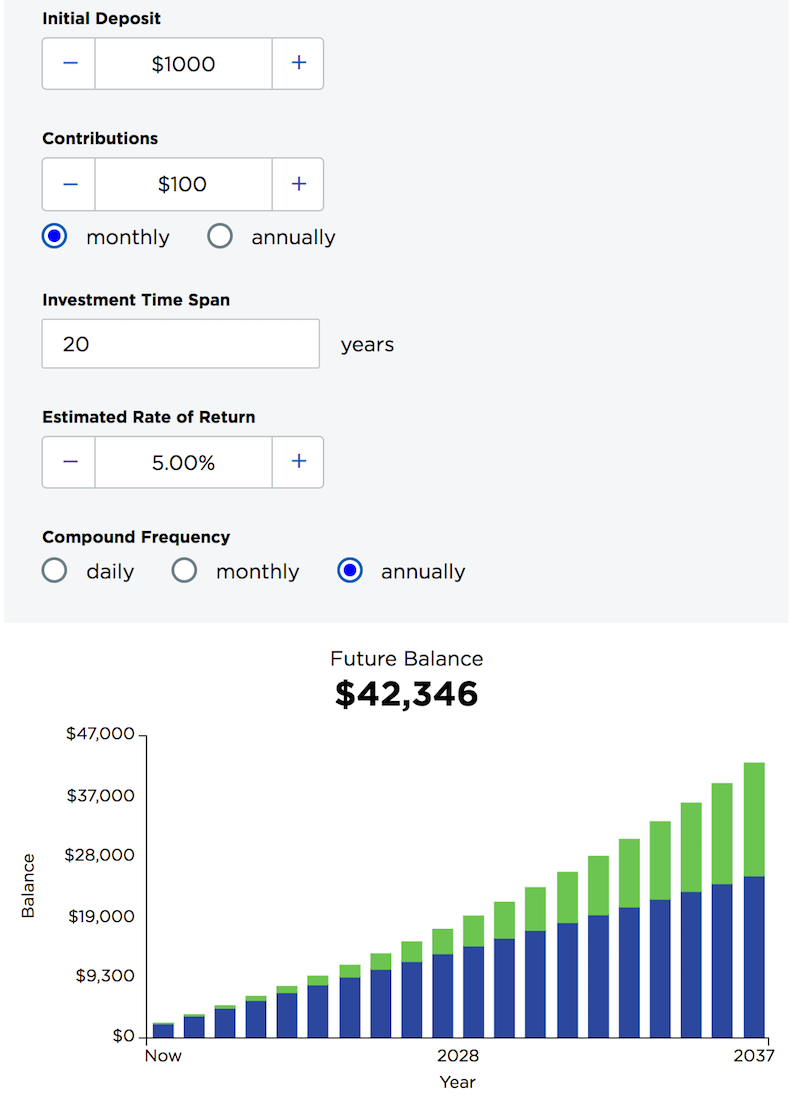

Well, how about $1000 into compound interest at 5% for 20 years, adding $100 monthly into this account?

That’s going to come out as $42,346 at the end of the period. Imagine putting this little nest egg away, with some automated transactions to ensure you’re putting that $100 a month away, and voila, $42,346 at the end of the road.

Now we’re talking!

The Joy of Compound Interest

The wonderful things about this principle, is that it can be applied to more things than just a savings account. Although life is very complex and messy, if you apply the resolve and consistency of compound interest to a particular area of interest, then you can make that particular thing also compound.

Things that compound – Healthy teeth over your lifetime

Some easy ideas of compound interest can start with this example; if you brush your teeth properly twice daily, you have a better chance of keeping your teeth in better shape than if you don’t. Congratulations, you’ve moved the needle in your favour. If you add a dietary choice to avoid sugary products, eat majority greens, whole grains and avoid heavily processed foods, and avoid smoking and heavy drinking, then you are most likely going to compound the value and quality of your teeth over time. Add in regular dental checks, and there is then a much higher guarantee of maintaining good teeth into your old age. All this, as opposed to someone who didn’t let these factors ‘compound’ though out the period of your life.

Things that compound – Useful Knowledge & Skills

As a young human mind develops, there comes a time to enter into formal educational settings. It’s generally accepted that the act and process of learning helps to grow knowledge about an area, and that if you apply the same, consistent forcus and energy on learning about something, your knowledge, skill and mastery of a certain thing will grow. This can be seen in the field of mathematics. From a very foundational standpoint, you must learn your 1, 2, 3’s. These beginning points then lead, in an ever upward trajectory, into larger and more complex fields of mathematical knowledge. Fractions, algebra, probability, trigonometry, statistics, calculus and so on.

However, you can’t just jump straight into learning about quadratic equations until you have gone through and gathered a strong understanding of the previous foundational mathematical principles. Maths is a body of knowledge where you have to start at the beginning. There’s no shortcut, and your understanding only compounds as you learn and master each area, before you can progress to the next.

Things that compound – Good Habits

Similarly, good habits such as daily exercise, getting to bed early so you wake up fully rested the next day, and a skincare routine which involves sunscreen, are all things which fight against general physical, mental and emotional decline as you age, keeping you healthy, limber and energetic. These routines and activities compound the more consistently you do them. Your body adapts and becomes more fit, healthier and more energetic the more you take care of it.

The Dangers of Compound Interest

“Compound interst is interest on interest, and it can make a dramatic difference in the value of your investments. As financiers often say, those who don’t understand compound interest are doomed to pay it.”

– Ann C. Logue ‘Hedge Funds for Dummies’

When Debt Compounds

This of course also applies to money and finance. Ignoring bills and failing to make loan repayments on time, underestimating high interest credit card debt, to the absolute ‘scam-like’ and dangerous practices such as ‘pay day’ loans and loan sharks. Once a situation get out of hand, it can continue to spiral until all your resources and security is taken away from you.

Debt, however, is inherently riskier because the future is unpredictable. A debtor who borrows from his future income to buy a house – courtesy of the savings borrowed, in turn, by a bank from its depositors, and then lent to the debtor in the form of a mortgage – does not know with certainty that he will earn enough money to be able to pay off his mortgage, because nobody can know the future with certainty. In contrast, if he were able to pay for the house in cash, he would be drawing on funds that he knows for a fact he has already saved. Likewise a banker who, courtesy of her depositors and bond holders, borrows from the bank’s future income to buy a mortgage-backed security. She does not know for a fact that her investment will pay off.

It’s important to note here, most things really are out of your control. Natural disasters, economic downturns and events which can be called ‘bad luck’ can and will happen. These are the ‘uncontrollable’ factors.

Paying off debt takes more effort than making profit – at compounding rates

“Paying off a given amount of debt will require the same amount of work (in the future) as it took, in the past, to accumulate the same amount of savings – more work, actually, since the debtor must pay interest to the saver for the loan. Neither borrowing nor lending is inherently good or inherently bad, or inherently lazy or ambitious.”

Conversely, if you don’t do such things as exercise, eating healthy, get consistently good quality sleep and make poor decisions, the principle of compound interest starts to work naturally against you. These factors, including illness and injury, can compound a decline in health and wellbeing in a steady downwards curve.

Compounding The Cycle of Poverty

“We’re even wrong about which mistakes we’re making.” – Carl Winfield

Because the magic of the principle of compound interest is seen more over time (and with more time, the more compound interest you see), people can then become very short-sighted about decision making – to the point where they make decisions accounting for immediate and probably irrational or unnecessary choices – in the heat of the moment, or disregarding the long-term, compounding consequences over time. Fingers crossed, we’re all going to be living long lives, so thinking in this way is pragmatic and probably better in the long run.

Avoiding Making Compounding Mistakes

“That mistakes are never made, that nothing is really accidental, is also the default theory of popular politics: major problems aren’t caused by human error; instead, some self-interested person or cabal must be at fault – special interests, lobbyists, or, indeed, greedy bankers. Mistakes don’t fit into standard economic and political models, because standard economic and political models take ignorance out of the human equation.

– Jeffrey Friedman “What Caused the Financial Crisis”

I would take a little bit from the special interests and lobbyists for sure, influencing outcomes is a factor. However I agree that sheer stupidity, ineptitude, corruption and ignorance are major driving factors.

We live in an ever more interconnected world. In my opinion, within healthy (and constantly revised and audited) regulation, a more interconnected world gives us the inherent “carrot” of everyone being able to access the some levels of wealth and thriving, and also from the “stick” end, stops large groups / organisations from either causing dangerous behaviours or ruining it for others – as we are all vested in our interests to get along with one another.

The Principle Harnessed | Grow What Matters

“To be sure, borrowing could not happen without lending, and thus saving; but just as lenders are rewarded for their past savings by borrowers, borrowers are rewarded for their future earnings by lenders. There is nothing undesirable about either side of this transaction.”

– Jeffrey Friedman, Richard A. Posner ‘What Caused the Financial Crisis’

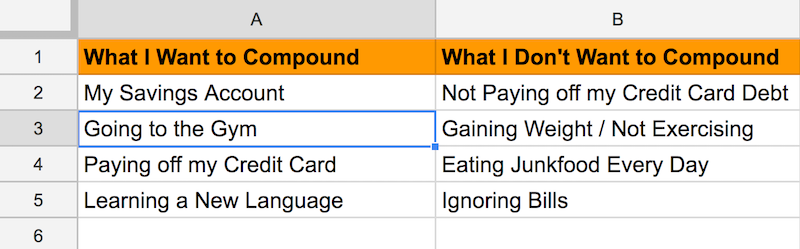

Q) In Your Life, What do you WANT to Compound? What DON’T you want to compound?

There’s an activity I’d like you to try out. It’s a simple two column exercise. Write the above sentence on the top of a piece of paper and make two columns, one labeled “want to compound” and the other “don’t want to compound”.

An example can look like this:

Now, after you’ve looked at the ‘want’ and ‘don’t’ columns, you can start to make actionable changes to makes these things happen (or to ensure they don’t).

Parting Note

Some people may argue that they’re not going to live for that long – and although that may actually happen, the odds are, you’ll live longer than you think. So, what’s a little bit of initial money, and a different mindset going to do to ruin your day? It sounds painful to start, but after, you’ll feel a rush of satisfaction, trust me. That’s great, so congratulate yourself and go on with your day knowing that now, compound interest is there working for you quietly in the background.